Made-in-Canada Hog Price Indicator

Under the direction of the Business Risk Management Committee, a consulting team completed its study exploring the opportunity and feasibility of establishing a Made-in-Canada Hog Price Indicator that better reflects the value of Canadian pigs.

Please click here to read the executive summary.

Please click here to read the report.

Mandate:

Explore the opportunity and feasibility of establishing a “Made-in-Canada” hog price based on relevant indicators to better reflect the value of the Canadian carcass.

Objectives:

-

To determine the value of Canadian pork versus that of major competitors in Canada’s key export markets: United States, Mexico, Japan and China

-

To identify and quantify the factors that contribute to determining the value of Canadian pork in the four markets

Findings:

- In most markets, the Canadian origin of pork products does not determine how buyers perceive their value.

- The main factors shaping product value are price, the brand and general quality specifications (ractopamine free for the Chinese market).

- The only market where the Canadian origin constitutes a differentiating factor is the Japanese market, resulting in an observable premium.

- One should note that the impact of the Canadian origin is compounded by the branding effort undertaken by Canadian packers.

- The premium value on the Japanese market is the result of the joint effort of all players across the Canadian pork value chain.

Objective:

3. To propose a set of market indicators that could be used to develop a “Made-in-Canada” live hog price based on a carcass cutout

Findings:

- The business structure of the pork industry has evolved

- Percentage of vertical integration (either corporate-owned or producer-owned) and contract production has increased

- This has resulted in a shrinking cash market for live hogs whose relevance is nowadays somewhat questionable.

- The use of a cutout-based price reference has spread.

- Unfortunately, in Canada, there is no transparency with respect to the value of the pork cutout because of a lack of market information.

- The price discovery process tends to reflect the prevailing business models.

- Going forward, a new model would not be able to be designed single-handedly by one set of actors within the value chain and pretend to maintain its relevance over time.

- Considering the current structure of the Canadian pork industry, a “Made-in-Canada” live hog price reference model should rely on the following market indicators:

- A cutout reference price or a composite price reference-based both on a live hog and cutout-based carcass price reference

- A Canadian premium:

- Recognizing the premium enjoyed by Canadian products in the Japanese markets, eventually weighted by the exposure of the Canadian pork production to the Japanese markets

- Recognizing the effort made by producers to raise hogs without using ractopamine to allow access to diverse markets

- A conversion coefficient:

- Accounting for the exchange rate, as the price reference would be derived from US data

- Correcting for technical equivalency (metric conversion, carcass weight, average carcass index

Price Reference Options

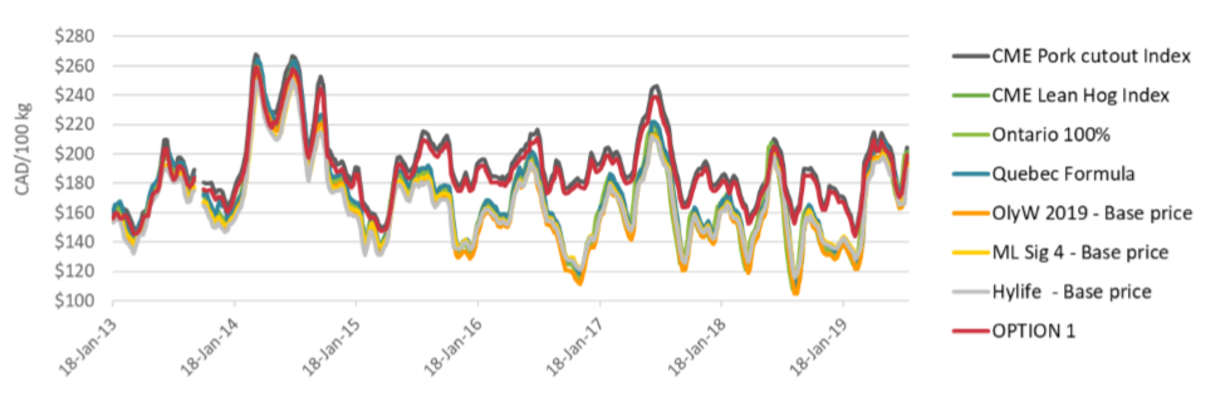

1. Cut-out only reference price

- Value share corresponds to the percentage of the cutout that would be paid to the producer. This percentage would have to be determined

- Completely aligning the price of live hog with the American cutout

- Reducing market volatility

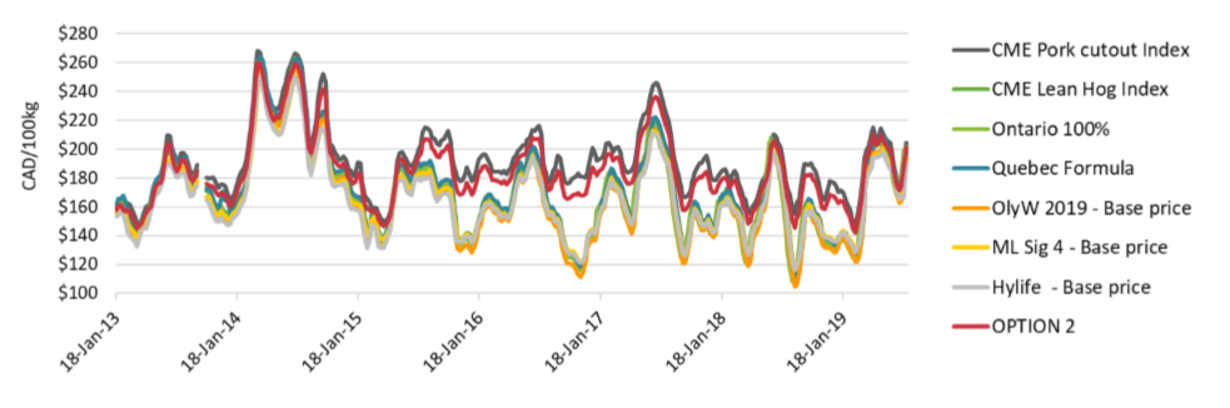

2. Composite Reference Price (weighted average)

- Reference price composed of a live hog reference and a cutout reference, weight to be attributed to each component would have to be determined

3. Composite Reference Price (live hog price with cutout window)

-

Reference price is based on a live hog reference with a floor and ceiling price based on a share of the cutout reference. This corresponds to the new Quebec Formula.

-

The value share would have to be determined for the floor and ceiling prices. Those values are respectively 90% and 100% in the Quebec Formula.